Analytic Accounting in Odoo is a very powerful, and flexible feature. For customers who are used to creating General Ledger accounts to serve as categories of revenue or expenses, the Analytic Account is a great way to limit the number of General Ledger Accounts.

In some ways, I prefer to consider an Analytic Account as a "Sub-Ledger" that allows a certain transaction to be categorized as belonging to another group of transactions.

Analytic Accounts can be used on all journal entries, including both the revenue and the expense sides of the company. When used properly, the analytic account can paint a very clear picture of the profitability of a certain project, job, or event.

Common uses of Analytic Accounts can be found below:

Job Costing / Gross Margin

Categorizing Company Expense Accounts

Project Based Accounting

Analytic Accounts for Job Costing

When we deploy Odoo for job based manufacturers or construction driven companies we typically rely on the Analytic Accounting module to isolate journal entries related to a job.

Through the course of implementation it's important to clearly identify when the job costing should begin and work forward from there to start to identify the costs associated. For example, some of our customers begin to generate entries to their Analytic Accounts as soon as an opportunity is identified as the cost of the sale can be calculated. For other customers, the Analytic Account does not start to group the expenses until the Sale Order is confirmed.

Odoo has an "out of the box" Analytic Report that can give a summary of the Gross Margin per job with real-time data to the users immediately.

Analytic Accounts for Expense Tracking

Analytic Accounts can be used for tracking all types of company expenses. Because we are in Louisiana I like to use the example of a company crawfish boil. If the company sets a budget for the event they can allocate certain expenses against that budget each time a vendor bill or expense report is posted.

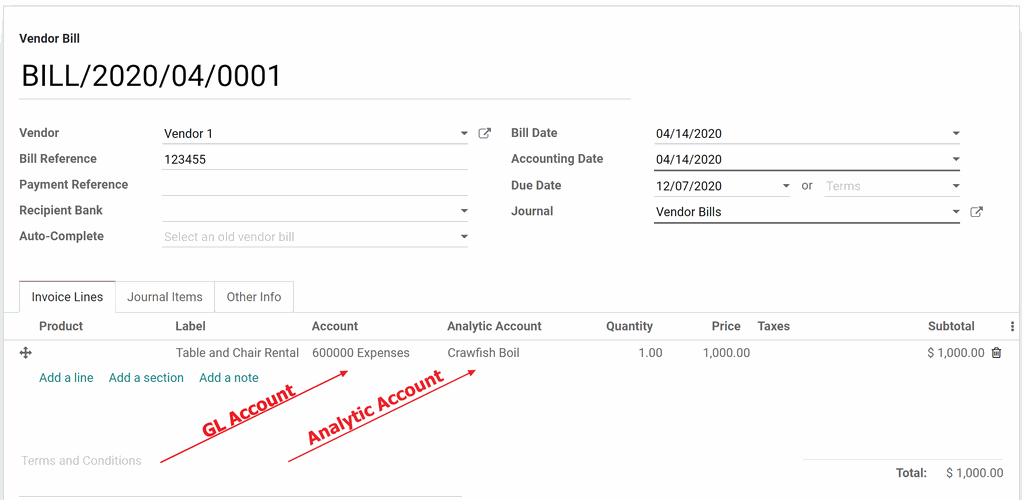

To do this, simply create an Analytic Account called "Crawfish Boil" and choose it during expense entry. Throughout the planning of the event the users can run the analytic report to see the total of the journal items charged to that Analytic Account.

In this simple example above, I have classified the expense for "Table and Chair" rental to the Crawfish Boil Analytic Account. I can run a report in accounting to see all of the related expenses for this company event.

Project Based Accounting

Analytic Accounts can be used in the Projects module of Odoo to classify a certain expense, or timesheet as being a cost of the project.

For example, if travel is required for a project, the user can classify their expense report to that projects Analytic Account and Sale Order. The cost of the travel will be included in the profit calculations of the the project, and the amount can be automatically re-invoiced to the customer for reimbursement.

Likewise, each employee of the company can be assigned a different hourly rate for their timesheets. Once an employee logs time against the project, Odoo automatically generates an analytic entry to calculate the value of that employees time. This entry can be viewed with the resulting timesheet invoices in the Analytic Report. The combination of these entries provides the management team with a profitability analysis of the project.

If you need help with this or any other module of Odoo, please Contact Us to learn more.